IFRS9 and IFRS 9 Software & Compliance Solutions

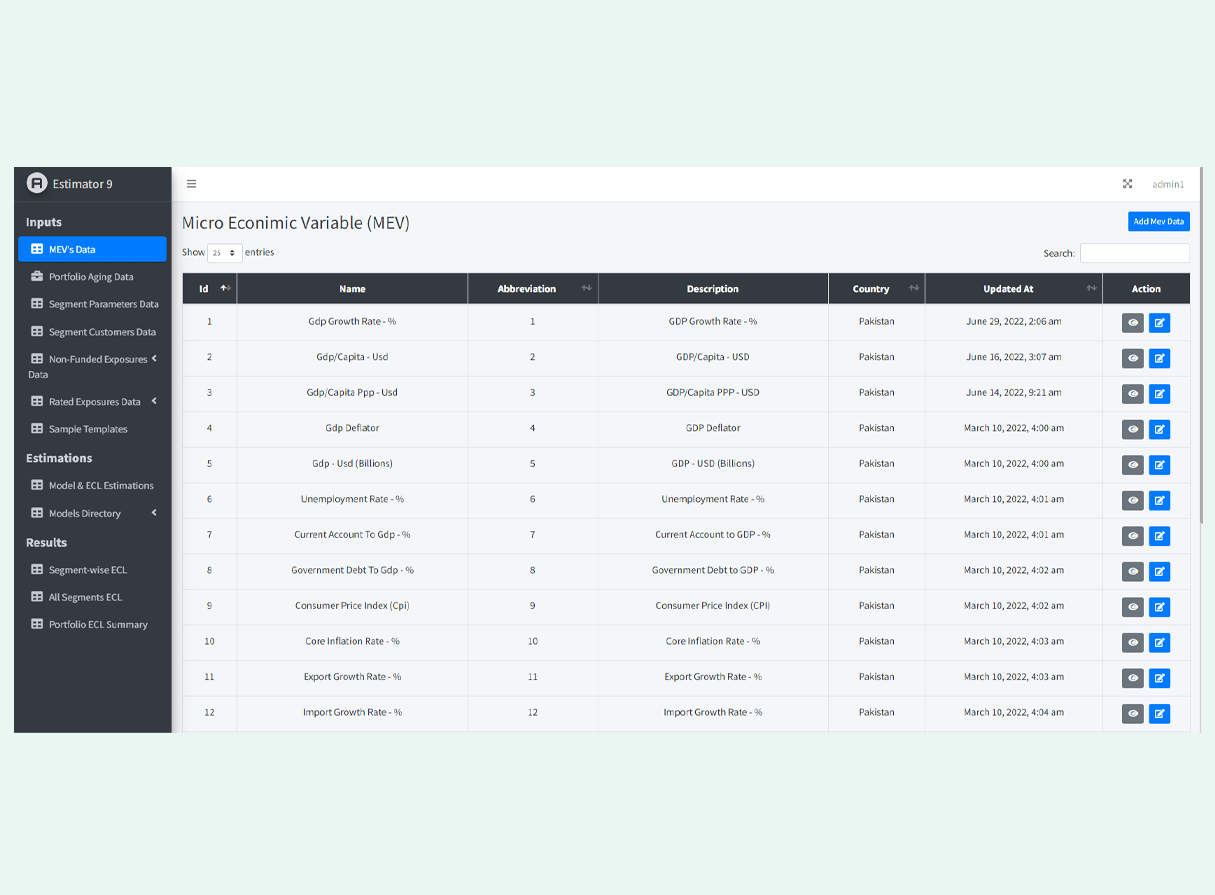

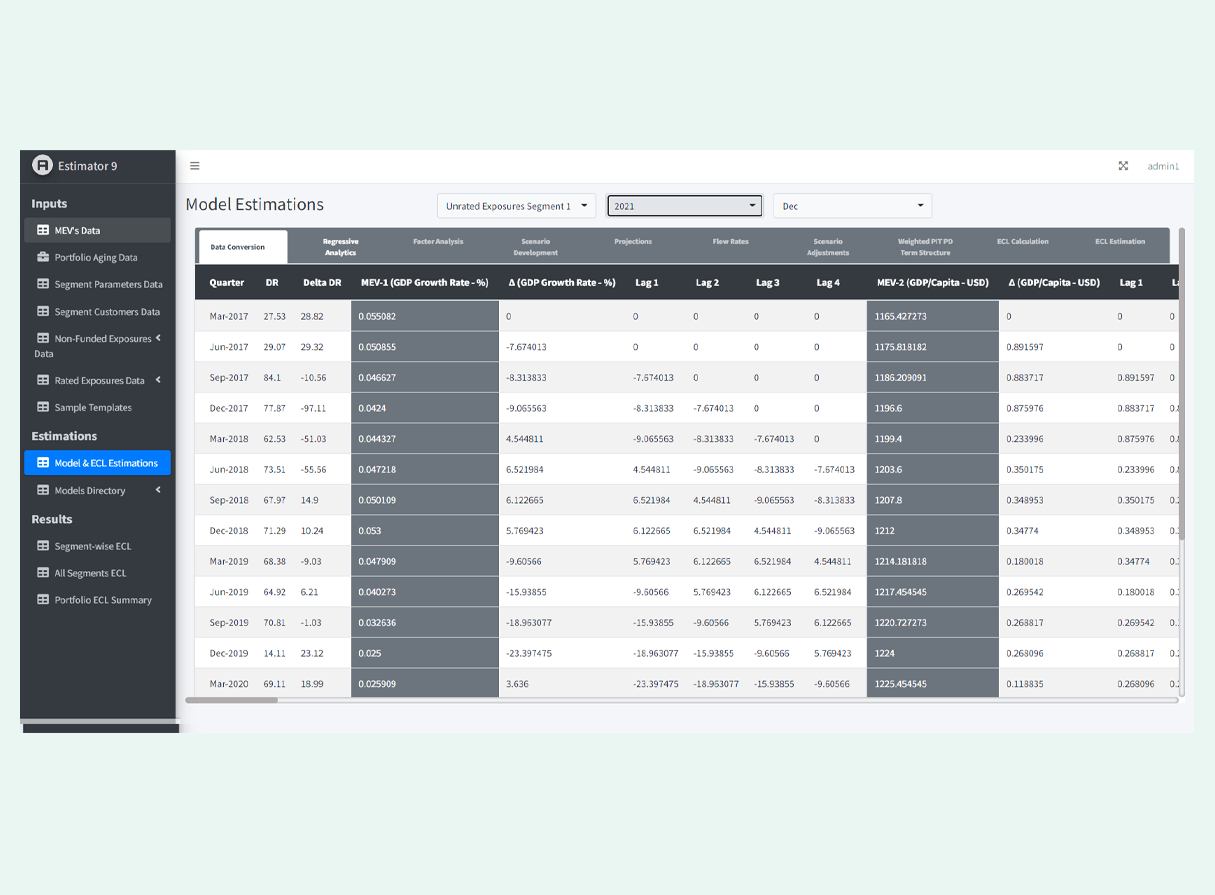

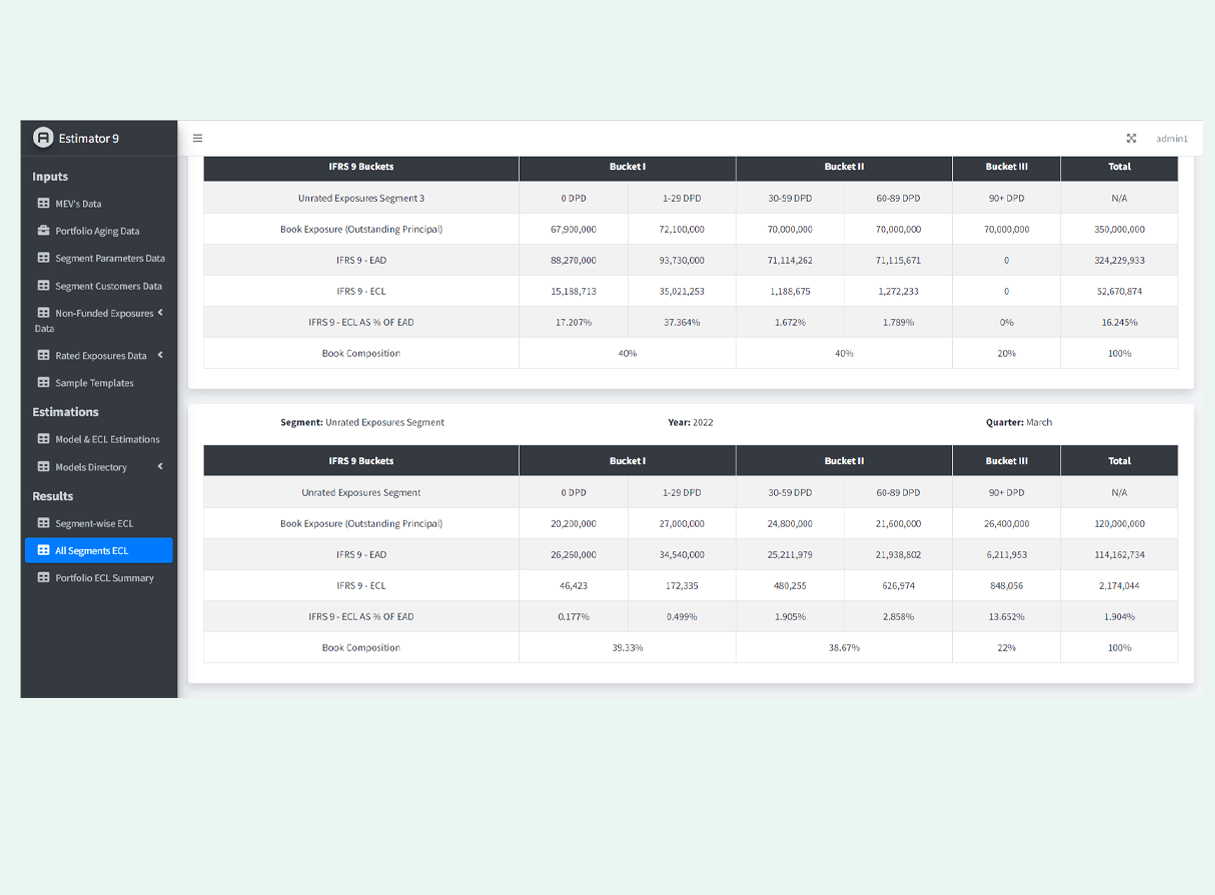

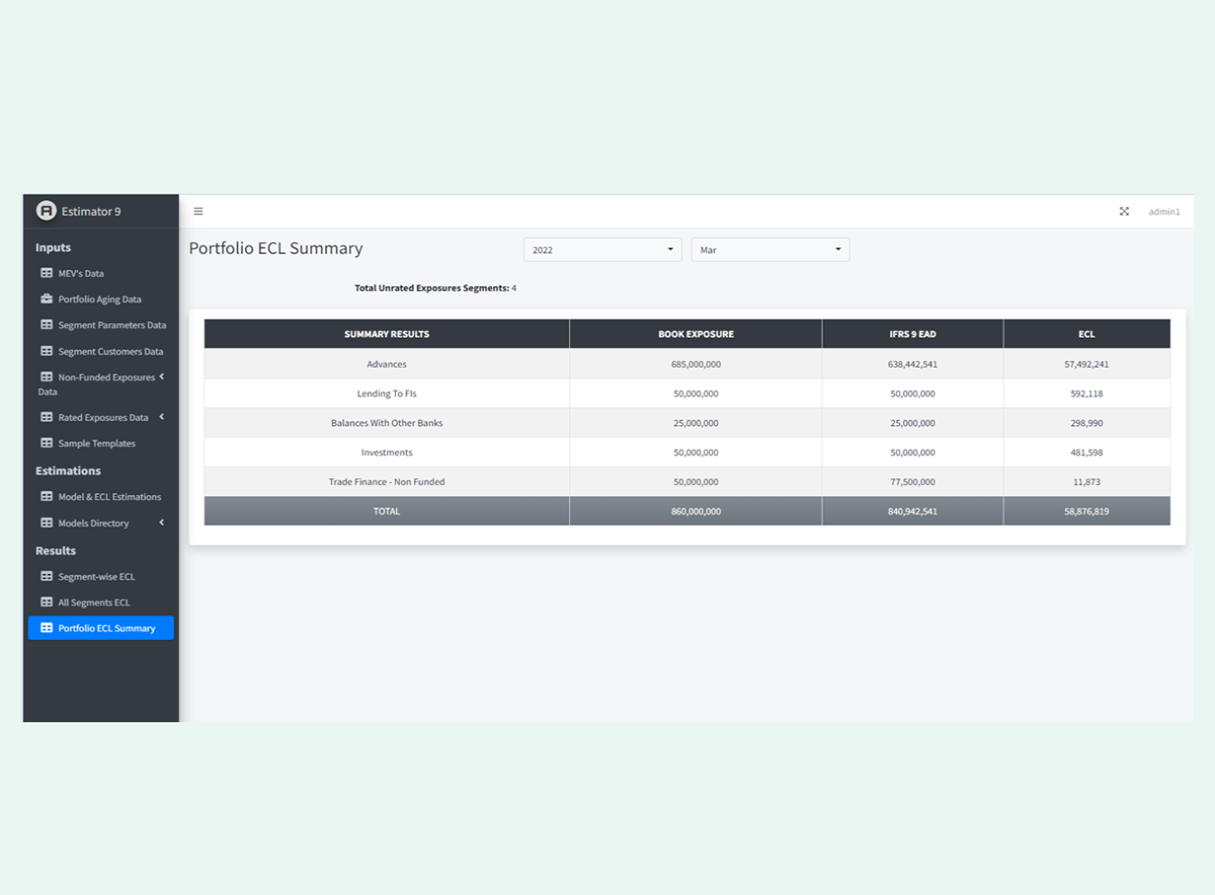

FineIT is providing IFRS9 and IFRS 9 software, IFRS 9 compliance software, ECL Software, and expected credit loss software for automated, accurate, and regulatory-compliant financial reporting. Estimator9 streamlines Expected Credit Loss (ECL), Probability of Default (PD), Exposure At Default (EAD), and Loss Given Default (LGD) for banks and enterprises.

Get DetailRegions Available

UAE

Saudi Arabia

Tanzania

Russia

Fiji

Kyrgyzstan

Uzbekistan

Pakistan

Kazakhstan

Australia

United Kingdom

New Zealand

Nepal

Oman

Hong Kong

Qatar

Germany

IFRS 17

FineIT provides IFRS 17 compliance software, Estimator17, designed to streamline the recognition, measurement, and reporting of insurance contracts. It supports accurate calculations of the Contractual Service Margin (CSM), risk adjustment, discounting, and fulfillment cash flows in line with IFRS 17 requirements. Moreover, it enhances actuarial modeling, financial disclosures, and data management, ensuring compliance with a forward-looking approach to insurance contract reporting.

Get DetailIFRS 17

IFRS 17 Insurance

IFRS 17 Insurance Contracts

IFRS 9

Risk Management

FineIT provides comprehensive risk management solutions, including model validation, regulatory compliance (Basel II, Basel III, IFRS9, IFRS 17), and advanced risk analytics. Our expertise in market and operational risk ensures accurate assessment and mitigation strategies. We help financial institutions enhance stability, optimize performance, and stay compliant with global standards.

Get DetailRisk Management

Model Validation

Market Risk Analysis

Operational Risk Analysis

ContractHive

Command your contracts with AI — streamline lease creation, approvals, and renewals; automate financial controls, asset onboarding, and reporting compliance in one secure, cloud-based platform for real estate, facility managers, and enterprise teams — complete with AI-powered OCR, IFRS 16 export, and real-time analytics.

Get DetailSmart AI-Lease Management

Automated Financial Control

Seamless Asset Onboarding

AI-Powered OCR Import

IFRS 16 Compliance

Dashboard & Analytics

Workflow Automation

Document Management

Reporting & Analysis